Land Transfer Tax in Toronto

March 10, 2023 | Buying

Land Transfer Tax in Toronto.

Land transfer taxes are often a forgotten cost of purchasing a property, but we’re here to change that with a little Q & A!

What is Land Transfer Tax?

- Land transfer tax in Toronto is a provincial & municipal tax paid when someone purchases a property.

- It’s different province to province, but it’s normally calculated as a percentage of the property value and can vary on higher-priced properties and what area of the city you live in.

Who Pays Land Transfer Tax?

The purchaser pays land transfer tax, as it transfers from the seller into their ownership.

When is it Paid?

- It’s paid on closing day through your legal team whose job it is to handle monies exchanging hands between the purchaser & seller.

How Much is Land Transfer Tax?

- Well that depends on a couple factors. 1st – there’s the location factor and whether you’re purchasing a home in the city of Toronto itself or a surrounding suburb. 2nd – there’s the sliding scale calculation based on purchase price.

1st

When purchasing a property in Toronto, a purchaser will be subject to paying both provincial and municipal taxes. Toronto is the only municipality in North America that has a double Land Transfer Tax.

2nd

The sliding scale. Tax is calculated a little differently percentage wise as the purchase price of the home increases. Different portions of the price are taxed more or less.

I’m a little confused , can you show me the breakdown?

- Absolutely!

Provincial Tax Equation

- 0.5% of the value of the property up to and including $55,000

- 1% of the value which exceeds $55,000 up to and including $250,000

- 1.5% of the value which exceeds $250,000; and

- 2% of the amount by which the value of the consideration exceeds $400,000

- 2.5% of the value that exceeds $2,000,000

Toronto Equation

- 0.5% up to and including the first $55,000

- 1% of the value which exceeds $55,000 up to and including $400,000

- 2% of the value over $400,000

Ok, I kind of get it, but I’m visual, can you show me an example?

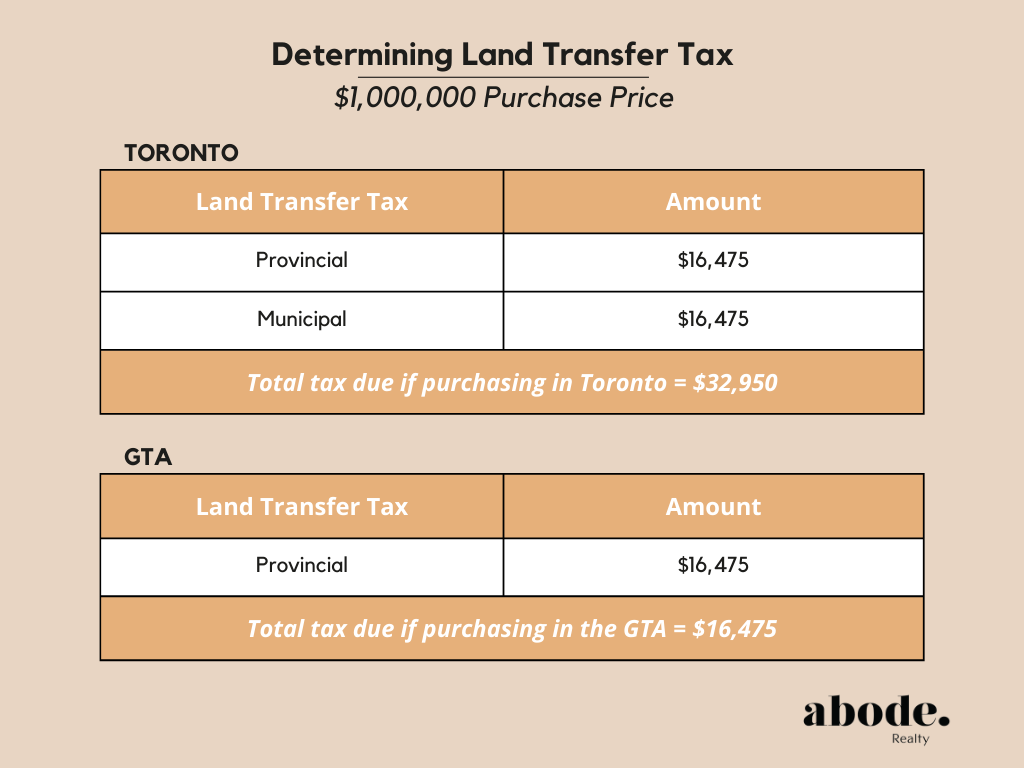

- You got it! We’re going to keep it simple and just get to the number you’d pay if you bought a $1M house in Toronto vs a neighbouring suburb like Markham or Pickering. At the end of the day, that’s all that really matters to you and your wallet.

Google is full of land transfer tax calculators, one of our favourites is Ratehub.ca. Use this link to instantly calculate how much land transfer tax you’ll be paying on a specific property.

Is it any different for a first time home buyer?

- Yes! If you’re just getting into the market as a first time home buyer wondering where you’re going to find all of this extra closing money – fret a little less! There’s something the government offers, called a 1st time Home Buyer Land Transfer Tax Refund.

First-time Home Buyer Land Transfer Tax Refund

- A first-time home buyers rebate is available for all purchasers who have never formerly owned a property anywhere else in the world. First-timers can qualify for a refund up to a maximum of $4,000 for the Ontario provincial portion of the tax. And up to $4,475 from the Toronto municipal land transfer tax.

If you’re a 1st time Home Buyer, be sure to check off the box in the Ratehub.ca link to instantly calculate your rebate on land transfer tax.

We hope you find all of this information valuable, but understand that it’s a lot to take in.

Got more questions? We’ve got more answers!

Reach out today and let’s clear the air on Land Transfer Tax in Toronto.